There are several ways to effectively market an IPO, but distress direct mail marketing with multiple messages from a mysterious third-party publisher is not one of them.

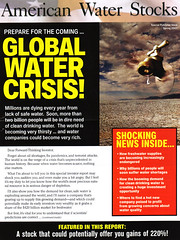

Of course, that did not stop Texas-based Royal Spring Water from giving it a go last week. A "special report" published under the banner of American Water Stocks, but devoid of contact information, claims two billion people will soon be in dire need of drinking water and that is why you should bank on a water stock with potential gains of 220 percent. As a communication observation, I can only guess

that Royal Spring Water is gambling on the idea that even a faceless smoke-and-mirrors endorser (but disclaimed as a paid non-endorser) can generate capital to offset operating losses.

Sure, this bottler and distributor of pure water from the Artesian wells of the "Ogallala Aquifer" has added a warehouse and distribution center in Los Angeles in order to meet sales demands in the state of California. It has reportedly concluded a private label deal with Vista Ford dealerships and Pacific Athletic Club, both in California, among others. And, its pitch that it has an exclusive "structured water" formula, sold under the label "RHYTHM Structured H2O — A life Changing Experience" sounds interesting enough.

Yet, this is precisely why one has to wonder about a company that would gamble with its reputation and possibly garner legal consequences by spending $20,000 with American Water Stocks in a mailer that comes dangerously close to crossing the stock "solicitation" line. (Right. For $20,000, you too could see your company projection to be "overperform" if you don't mind the half-page disclaimer underneath that refutes its own claim, assuming you can find the ghost of a company that did the piece.)

The reason why aside, the multiple messages mangle any sense of logic. The opening message to "forward-thinking investors" reads:

"Forget about oil shortages, flu pandemics, and terrorist attacks. The world is on the verge of a crisis that's unprecedented in human history. Because when water becomes scarce, nothing else matters.

What I'm about to tell you in this special investor report may shock you, sadden you, and even make you a bit angry. But I feel it's my duty to let you know how the world's most precious natural resource is in serious danger of depletion.

I'll also show you how the demand for clean, safe water is exploding around the world, and I'll name a company that's gearing up to supply this growing demand—and which could potentially make its early investors very wealthy as it grabs a share of the $420 billion market for freshwater."

The mysterious "I" person is never named, but goes on to fulfill his or her promise that 12 pages of fear marketing can indeed shock, sadden, and even make people feel angry. Unfortunately, not for the reasons they hope.

You see, it's no surprise to me that the executive management team of Royal Spring Water got their start as independent film producers of movies that didn't go anywhere (one was about how a transcriptor struggles to keep up with the rapidly changing technology around her. Oh my!). Today's equally compelling plot line links the end-of-the-world water to unbelievable stock gains. Simply put, it is investor prospecting communication at its very worst.

Look, there is no refuting clean drinking water is an issue worth consideration or that the bottled water industry is booming (Aquafina, Dasani, Arrowhead, and others all posted gains last year), but this hardly doubles as an excuse to misrepresent paid advertising as a special report from a third-party source. And personally, I would be disappointed to see more of it.

Lessons for today: First, never risk your company's reputation for a get-rich-quick stock scheme, especially when you seem to have a markable product. Second, never assume in today's world that your targeted mailer will only be seen by unsavvy investors willing to gamble on your hype. One of them just may be a member of the social media with an eye out for communication. Good. Bad. Or indifferent.

Of course, that did not stop Texas-based Royal Spring Water from giving it a go last week. A "special report" published under the banner of American Water Stocks, but devoid of contact information, claims two billion people will soon be in dire need of drinking water and that is why you should bank on a water stock with potential gains of 220 percent. As a communication observation, I can only guess

that Royal Spring Water is gambling on the idea that even a faceless smoke-and-mirrors endorser (but disclaimed as a paid non-endorser) can generate capital to offset operating losses.

Sure, this bottler and distributor of pure water from the Artesian wells of the "Ogallala Aquifer" has added a warehouse and distribution center in Los Angeles in order to meet sales demands in the state of California. It has reportedly concluded a private label deal with Vista Ford dealerships and Pacific Athletic Club, both in California, among others. And, its pitch that it has an exclusive "structured water" formula, sold under the label "RHYTHM Structured H2O — A life Changing Experience" sounds interesting enough.

Yet, this is precisely why one has to wonder about a company that would gamble with its reputation and possibly garner legal consequences by spending $20,000 with American Water Stocks in a mailer that comes dangerously close to crossing the stock "solicitation" line. (Right. For $20,000, you too could see your company projection to be "overperform" if you don't mind the half-page disclaimer underneath that refutes its own claim, assuming you can find the ghost of a company that did the piece.)

The reason why aside, the multiple messages mangle any sense of logic. The opening message to "forward-thinking investors" reads:

"Forget about oil shortages, flu pandemics, and terrorist attacks. The world is on the verge of a crisis that's unprecedented in human history. Because when water becomes scarce, nothing else matters.

What I'm about to tell you in this special investor report may shock you, sadden you, and even make you a bit angry. But I feel it's my duty to let you know how the world's most precious natural resource is in serious danger of depletion.

I'll also show you how the demand for clean, safe water is exploding around the world, and I'll name a company that's gearing up to supply this growing demand—and which could potentially make its early investors very wealthy as it grabs a share of the $420 billion market for freshwater."

The mysterious "I" person is never named, but goes on to fulfill his or her promise that 12 pages of fear marketing can indeed shock, sadden, and even make people feel angry. Unfortunately, not for the reasons they hope.

You see, it's no surprise to me that the executive management team of Royal Spring Water got their start as independent film producers of movies that didn't go anywhere (one was about how a transcriptor struggles to keep up with the rapidly changing technology around her. Oh my!). Today's equally compelling plot line links the end-of-the-world water to unbelievable stock gains. Simply put, it is investor prospecting communication at its very worst.

Look, there is no refuting clean drinking water is an issue worth consideration or that the bottled water industry is booming (Aquafina, Dasani, Arrowhead, and others all posted gains last year), but this hardly doubles as an excuse to misrepresent paid advertising as a special report from a third-party source. And personally, I would be disappointed to see more of it.

Lessons for today: First, never risk your company's reputation for a get-rich-quick stock scheme, especially when you seem to have a markable product. Second, never assume in today's world that your targeted mailer will only be seen by unsavvy investors willing to gamble on your hype. One of them just may be a member of the social media with an eye out for communication. Good. Bad. Or indifferent.